ESCO - a way to green transformation with zero own contribution

Inefficient infrastructure and limited investment budgets are two main problems that large and medium-sized industrial enterprises in Poland constantly struggle with. The managers of these companies must find solutions that will bring immediate savings and ensure long-term efficiency. In this context, the ESCO financing model emerges—a method of financing in which the client implements the investment project without engaging their own funds.

What is ESCO?

The ESCO (Energy Service Company) financing model is based on the concept that the ESCO designs, implements, finances, and manages projects aimed at improving energy efficiency and reducing energy consumption in companies or institutions. A key element of this model is that the ESCO assumes a significant part of the risk related to the implementation and outcomes of the project, including investment costs. In return, the client pays the ESCO from the savings achieved as a result of the implemented actions.

What is the ESCO Model?

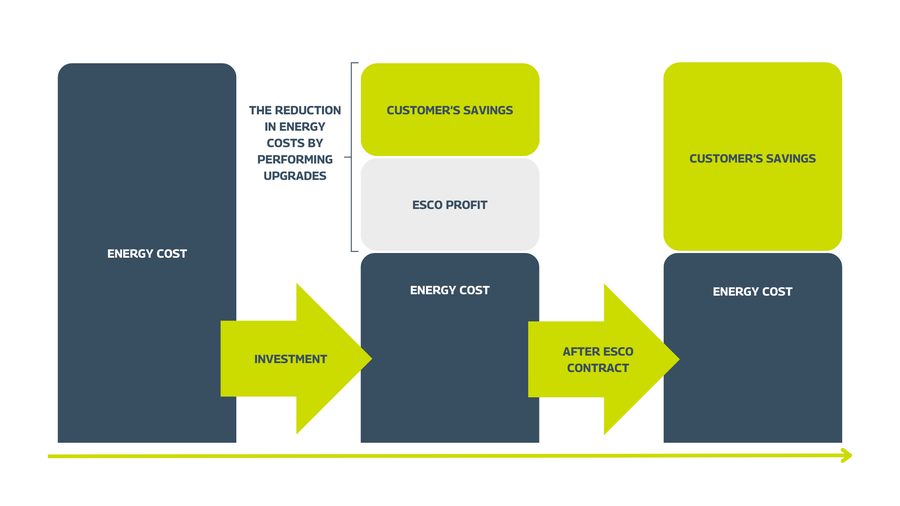

The ESCO financing model is based on a contract in which the ESCO covers the costs of purchasing and installing equipment, upgrading infrastructure, and carrying out other activities aimed at improving energy efficiency. The client then pays the ESCO a fixed amount or a percentage of the savings achieved through the implemented projects. This can be a fixed monthly or quarterly fee, based on the actual savings compared to previous energy costs, or a variable fee based on the scale of the financial benefits obtained by the client.

This financing model offers many benefits to clients, including immediate savings, minimal or no costs during the investment phase, significantly reduced investment risk, and professional support in energy management. For ESCOs, it is a way to generate income by providing energy efficiency services and motivating companies to invest in green technologies.

The first and most attractive benefit offered by the ESCO model is immediate savings. From the first year after the investment, the modernized installation generates positive cash flows for the company. This is particularly important in today's dynamic business environment, where quick returns on investment are key to maintaining competitiveness. In the ESCO model, remuneration is usually dependent on the results obtained, meaning the company implementing and financing the investment is highly motivated to achieve the greatest possible savings for the client.

The ESCO model eliminates the need for the client to use their own financial resources for investments. The company does not have to engage its own capital while still enjoying the benefits of improved energy efficiency. Additionally, a very important aspect increasing the attractiveness of the ESCO model is the possibility of keeping such a project off the balance sheet.

In the ESCO contract implementation model developed by us, these contracts do not have to increase the client's level of liabilities—they can be off-balance sheet. Moreover, the lack of engagement of own funds translates into an immediate improvement in the client's financial liquidity. - explains Piotr Danielski, PhD, Vice President of DB Energy, firm offering an ESCO financing model.

Financing flow in the ESCO model, source: own study.

The ESCO company not only finances the investment but also ensures long-term improvement in the energy efficiency of the industrial installation. As a result, the client can be confident that their infrastructure will function optimally, translating into operational stability and a long-term increase in the company's profits. Transferring the responsibility for the implementation of the investment to the ESCO also means reducing the technical risk for the client. The ESCO company manages all stages—from diagnosis and design to execution and long-term maintenance. For the client, this means peace of mind and the certainty that the project will be carried out professionally and effectively.

In traditional investment models, the company commissioning the general contractor often has to consider the interests of this entity, which may conflict with its own. With a fixed (usually lump sum) remuneration for the general contractor, this entity must maintain the assumed level of project implementation costs, which in a dynamically changing market environment often leads to a decrease in the quality of implementation. In the case of ESCO, both the client and the ESCO share a common economic interest—maximizing savings. Therefore, within such an investment, the most important decision-making criterion is the ratio of economic benefits to the investment outlays incurred, rather than merely the costs. Additionally, the ESCO's involvement does not end after the investment is completed. On the contrary, it often offers analysis of additional tasks that can contribute to further reductions in energy consumption. This enables companies to continuously improve their infrastructure, achieving greater savings in the long term.

The ESCO financing model is an ideal solution for companies looking for effective methods to improve the energy efficiency of their infrastructure. With immediate savings, financial optimization, a long-term guarantee of efficiency improvement, and reduced technical risk, ESCO enables Polish companies to carry out green transformation without the need for large investments of their own financial resources. The value of the ESCO market in Poland is constantly growing, indicating increasing awareness and acceptance of this financing model. For Polish entrepreneurs, the ESCO model is not only an opportunity for savings but also a pathway to sustainable development and increased competitiveness in the market.